What the coronavirus stimulus package means for individuals, retirees and the Australian economy

With the COVID-19 coronavirus crippling the Australian economy and affecting livelihoods, the Australian Federal Government has announced a range of measures to support both businesses and individuals.

The information in this article was last updated on Wednesday 25 March.

The total stimulus announced to date is worth $189 billion, or 10% of the size of the Australian economy, and the government has said more financial support will be announced over the coming months.

Here we explain some of the benefits you may be eligible for.

Coronavirus supplement

For the next six months, the government will establish a new coronavirus supplement worth $550 per fortnight. This will be paid to both existing and new recipients of JobSeeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit, doubling the payment for those currently on these benefits to $1,100 per fortnight. Students receiving Youth Allowance, Austudy and Abstudy will also be eligible.

Asset tests and waiting periods that typically apply to these types of payments will be waived, and eligibility will be extended to permanent employees who are temporarily stood down.

Sole traders, the self employed, casual workers and contract workers whose volume of work has been affected may also be eligible, provided they’re earning less than $1,075 a fortnight. These payments will begin from 27 April 2020.

Household stimulus payments

The government is providing two separate, tax-free $750 payments to social security, veteran and other income-support recipients, including those on the Age Pension, and eligible concession card holders.

The first payment will be made from 31 March 2020 and the second payment from 13 July 2020.However, people eligible for the coronavirus supplement (detailed above) won’t be entitled to the second payment.

It’s expected that up to 6.6 million people will be eligible for the first payment and around five million for the second payment, with around half of these pensioners.

Temporary access to super

The government will allow some people affected by the coronavirus to access up to $10,000 of their super between now and 1 July 2020, and a further $10,000 in the first three months of the 2020-21 financial year, tax free.

Those who are eligible include the unemployed, people receiving JobSeeker Payment, Youth Allowance Jobseeker, Parenting Payment, Farm Household Allowance and Special Benefit. And also people who’ve been made redundant, had their work hours reduced by 20% or more or sole traders whose turnover has reduced by 20% or more since 1 January this year.

Applications can be made online from mid-April by using myGov. Members will self-certify that they satisfy the eligibility criteria. Please contact us on Ph: (07) 3026 3600 to discuss.

Support for retirees

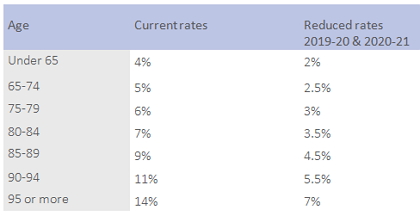

To assist those in retirement the government is temporarily reducing minimum super drawdown requirements for account-based or allocated pensions, annuities and similar products by 50% for the current financial year and the 2020-21 financial year. This should reduce the need for retirees to sell investment assets in the current soft sharemarket conditions to fund their minimum drawdown requirements.

In addition, the upper and lower social security deeming rates will also be reduced by 0.25% from 1 May in recognition of the impact of persistent low interest rates on retirees’ savings. This comes on top of a 0.5% reduction announced earlier in March.

The government says the change will benefit around 900,000 income support recipients, including around 565,000 people on the Age Pension who will, on average, receive around $105 more from the Age Pension in the first full year that the reduced rates apply.

Minimum payment rates for account-based and allocated income streams

Source: Australian Government’s Economic Response to the Coronavirus: treasury.gov.au/coronavirus

State and territory stimulus

The state and territory governments have also announced economic stimulus packages. The majority of these have so far focused on businesses, however there have been a few measures for individuals, including:

-

Western Australia: The WA Government has frozen scheduled increases for household fees and charges, including electricity, water, motor vehicle charges, the emergency services levy and public transport fares, which were previously due to increase by $127 from 1 July. And the Energy Assistance Package, which is available to eligible concession card holders, will be doubled from $300 to $600 from 1 July.

-

Tasmania: The Tasmanian Government has announced one-off payments of $250 for individuals (or up to $1,000 for families) who are required to self-isolate. Recipients must hold a Health Care Card, Pensioners Concession Card or be low-income earners who can demonstrate a need for financial support, including casual workers.

-

Australian Capital Territory: The ACT Government will give rebates of $150 on household rates, as well as freeze a number of fees and charges, including the fire and emergency services levy, public transport, vehicle registration and parking fees. Public housing tenants will receive $250 in rental support, as well as a one-off rebate for residential utility concession holders of $200 to help with power bills.

-

Queensland: The Queensland Government has announced a $200 rebate for all Queensland households (including the $50 Asset Ownership Dividend already announced) to offset the cost of water and electricity bills, which will be automatically applied through electricity bills.

Outlook for the Australian economy

AMP Capital Senior Economist Diana Mousina says that while the government stimulus is welcome, it’s unlikely to be enough to keep Australia from falling into recession.

Ms Mousina says that the combined economic impact of the summer bushfires, lower Chinese tourism and education spending, global coronavirus shutdown and recessions in the US and Europe will all take a toll, however the government’s spending measures should help to limit the severity of the downturn.

“The fiscal stimulus package will help in limiting the depth of the Australian recession, it will help to keep companies afloat (and should provide some limit for keeping the unemployment rate from skyrocketing) and it is necessary to get a strong recovery after the virus has run its course.”

Due to the uncertainty around the country’s economic position, the Federal Government has also announced that it will postpone the next Federal Budget. The budget is usually handed down in May, but has been postponed until 6 October 2020.

Please contact us Ph: (07) 3026 3600 if you would like to discuss.

Source: Australian Government’s Economic Response to the Coronavirus: treasury.gov.au/coronavirus